The Matolcsy family’s enrichment was again highlighted by a report published by the State Audit Office a few weeks ago, which found that the Hungarian National Bank’s (MNB) foundation suffered a serious loss of wealth due to bad investment decisions during György Matolcsy’s presidency of the central bank. The report also revealed that millions of euros of the lost funds went to the circles of Ádám Matolcsy, the son of the central bank president who left his post in March this year.

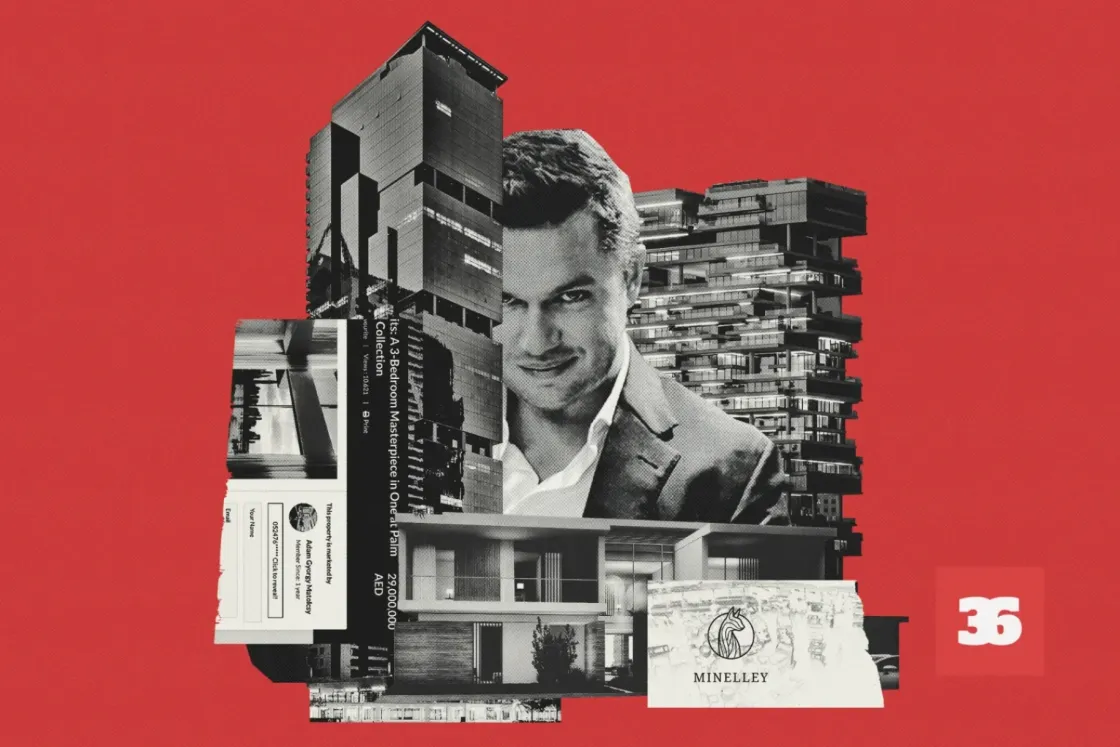

Direkt36 has now obtained new evidence that Ádám Matolcsy, who has made a spectacular fortune in recent years, is running more extensive business in Dubai than previously known. One of the best-known cities in the United Arab Emirates, Dubai is popular with billionaires who want to do business in hiding. Local regulations allow business and property owners to hide in plain sight.

However, Direkt36 also found two companies operating in the desert metropolis that are clearly linked to the son of the former central bank governor. One of them bought luxury properties in Dubai worth several millions of euros, one of which was later rented by Ádám Matolcsy. The other is doing different types of business.

One of the companies, Future Holding Limited, bought a 286 square metre luxury apartment in Dubai for the equivalent of EUR 2.7 million in 2018. The company sold the apartment in 2024 for a significant profit of around EUR 6.1 million. Direkt36 previously reported on Future Holding and the sale of the property in the framework of an international investigation. At that time, we also found out that the company was closely linked to the circles of Ádám Matolcsy. This time, we found evidence that the company is also directly linked to György Matolcsy’s son.

The other company operating in Dubai is Minelley, which until now was not known to be linked to Ádám Matolcsy. According to Direkt36, this company is also involved in serious real estate deals; for example, it has rented a 115 square metre office in Dubai’s business district, and in 2023 it leased a luxury villa of almost 1,200 square metres for a year for a price of approximately EUR 495,000. The company handles financial coordination and visa operations, among other things.

We have sent several questions relating to this to Ádám Matolcsy. We asked him, among other things, about his connection to these companies, but he did not respond.

Real estate deals worth billions

In January 2024, a real estate advertisement was published in the name of Ádám Matolcsy on a real estate website in the United Arab Emirates. “Step into an extraordinary space of more than 3,616 square feet, where every corner whispers stories of luxury,” reads the text of the ad, which gave the property’s floor area in Anglo-Saxon units.

The ad used such pompous words for a reason. The three-bedroom residence for sale overlooks the Persian Gulf. It includes 50 square metres of a terrace and balcony, and a separate room for staff. Not only does the 9th-floor apartment – located in the 25-storey One at Palm Jumeirah, on Dubai’s famous Palm Jumeirah island – offer lavish amenities, but so does the entire building. Residents have access to a private cinema room, swimming pools, a sauna and a private jetty.

They managed to find a buyer for the apartment relatively quickly. According to documents obtained by Direkt36, the property was sold in March 2024 for nearly EUR 6.1 million. It is not clear why the advertisement remained available after that, but it is possible that it was deleted after the sale.

Although the advertisement was placed under Matolcsy’s name, the owner of the property at the time of the sale was a Dubai-based company called Future Holding Limited.

Direkt36 wrote about this company and the property itself in the spring of 2024, in the context of the international investigation Dubai Unlocked. The background to this was that the Washington-based Center for Advanced Defense Studies on International Crime (C4ADS) had obtained a database containing information on the owners of hundreds of thousands of Dubai properties. It then shared it with the Norwegian business newspaper E24 and the Organized Crime and Corruption Reporting Project (OCCRP), an investigative journalism network that coordinated the project involving dozens of newsrooms. In Hungary, Direkt36 was the only Hungarian newspaper involved in the investigation.

Based on the documents obtained in this way, we previously reported that the company Future Holding had bought the above-mentioned property in the autumn of 2018 for the equivalent of approximately EUR 2.7 million at the time. Our previous article also revealed that the contact details of Future Holding included email addresses linked to a company founded by Ádám Matolcsy, his former wife who was still married to him at the time of the transaction, and an old acquaintance and colleague.

The real estate photos in the newly discovered ad are identical to those previously uploaded to a public Pinterest account with the name of Ádám Matolcsy. In addition, the text of the advertisement states that the property could be bought “directly from the owner”. Since Future Holding was not named in the ad, the owner was probably the same person who posted the ad, namely Ádám Matolcsy.

In mid-April, opposition MP Ákos Hadházy posted the advertisement on his Facebook page, and in response, Ádám Matolcsy told Telex that he was not the one who had posted the ad. Afterwards, we asked Ádám Matolcsy how his name could have appeared next to the advertisement, but he did not respond to our question.

Future Holding, which is linked to Ádám Matolcsy, has also bought other properties in addition to the residence advertised. According to our previous article, one of these was a 1,200 sqm, 5-bedroom luxury villa called “Signature Villa”, also on the palm-shaped island of Dubai. After Future Holding bought this property, worth EUR 9.4 million, Ádám Matolcsy signed a one-year lease in the summer of 2023. This meant that the rent of around EUR 150,000 per year was paid to a company with which he himself had multiple ties.

Visa transaction management

The Dubai-based company Minelley DMCC is certainly not trying to win customers through its website. In fact, the company’s website only features a background image of downtown Dubai, a logo resembling a cat and an address in Dubai. There is no link to the site, nor is there any information about the company’s activities in any particular industry.

Until now, this company could not be linked in any way to the son of the former central bank governor, but now we have found out that this company is also closely linked to Ádám Matolcsy.

According to the information we have obtained from the Dubai company database, Tímea Matolcsy, then wife of Ádám Matolcsy, was an officer of Minelley from 2017, when the company was founded.

The close relationship between Ádám Matolcsy and Minelley is also indicated by the real estate advertisement published in January 2024 in the name of Ádám Matolcsy, mentioned earlier. Among the contact details given, there is an email address ending in minelley.ae, which belongs to the company Minelley. It was therefore possible to apply for the advertisement posted under the name of Ádám Matolcsy via a Minelley email address.

In addition, a website that archives web pages first recorded Minelley’s website in January 2024, the very day its luxury property ad was posted on the internet.

Minelley also has other real estate deals, according to documents obtained by Direkt36. The company has previously rented several properties in Dubai. One of these is a 115 square metre office in a tower block in the city’s business district. The address of this office is the same as the one listed on Minelley’s website.

We have also obtained another leaked document relating to property leases. According to the document, Minelley rented a luxury villa of nearly 1,200 square metres with 6 bedrooms and a hall for a year in July 2023 in a row of villas in the suburbs of Dubai. The rental cost was nearly EUR 495,000 for a full year at today’s exchange rates.

Minelley is extremely secretive about what it does, and the official database of the Emirates only reveals that they are involved in feasibility studies.

However, some information posted on professional social networking sites hints at what the company’s true scope of activity may be. For example, one manager writes in her professional profile that, in addition to developing office processes and coordinating finances, her duties at the company include managing visa transactions and government-related services. (We asked the Hungarian Ministry of Foreign Affairs and the government of Dubai whether Minelley had any relationship with them, whether the firm handled visa matters for their citizens, but received no response from either.)

The fact that Minelley has a specific legal status within the Emirates may also help to explain the company’s activities. This is because Dubai is home to a number of special free trade zones with specific regulations. Within these, under certain conditions, foreign nationals can easily and quickly set up small companies which they can then operate under very favourable tax conditions. However, their opportunities for growth are limited, as there are strict regulations on the number of employees such companies can have.

One such zone is called DMCC (Dubai Multi Commodities Centre), which is also included in the official name of Minelley. Kinga Judit Szabó, a Dubai business expert, told Direkt36 that the DMCC zone is mainly for companies that deal in gold, diamonds, tea, grains and other commodities on the commodity exchange, or ones that operate retail units in the zone. According to Szabó, it is not financially viable for businesses that do not carry out this type of activity to operate here. Other zones are more suitable for other types of activity.

Starting a business in Dubai also means that the owner can apply for an investor visa. This can be extended to his family, and even a limited number of company employees are eligible for the visa. According to Szabó, for smaller companies operating in free trade zones, 3 to 4 employees are eligible for the visa in addition to the owner.

Billions for friends

Although the SAO’s report on the central bank’s foundation management, published in March this year, does not discuss Ádám Matolcsy’s business activities, it does detail several investments linked to the central bank’s foundation, which have generated millions of euros for Ádám Matolcsy’s circle of friends. (Direkt36 was the first to write about the report before its official publication.)

One of these was a real estate project in Balatonakarattya, the BOKK investment. According to the State Audit Office, when it came to carrying out this multi-million euro project, the trustee of the Hungarian National Bank’s foundation mostly contracted companies belonging to the same circles of interest. Bálint Somlai, an entrepreneur close to Matolcsy, was behind the business groups involved. Ádám Matolcsy had earlier confirmed to Direkt36 that he and Somlai belonged to the same group of friends.

According to the SAO, something similar could be observed in the case of the foundation’s investment in the Burg Hotel in the 1st district of Budapest. Here, almost 99 per cent of the total value of the contracts was signed with companies owned by Bálint Somlai.

The Hungarian State Audit Office did not mention this, but Ádám Matolcsy used to live in a property that was originally owned by the Hungarian National Bank. This villa in District XII was bought by the central bank’s foundation in 2015 for about EUR 3.2 million at today’s exchange rate to set up a training and research centre. The building was eventually sold to a private equity fund in 2019. In 2022, Ádám Matolcsy said that he had lived in the villa before and that it was possible that he would use it again in the future.

Ádám Matolcsy owes much of his rise to the Hungarian National Bank, which was headed by his father until recently. Back in 2015, he took out a loan from NHB Bank, which is linked to György Matolcsy’s cousin Tamás Szemerey, to buy a long-established furniture factory, Balaton Bútor in Veszprém. The original source of the money was MNB’s Growth Loan Programme. It was later revealed that Balaton Bútor supplied furniture to the MNB-owned Posta Palota. In 2018, Ádám Matolcsy was one of a small group of entrepreneurs who withdrew their money from the financially troubled NHB in time.

This article is part of a partnership between Telex and Hungarian investigative journalism center Direkt36.